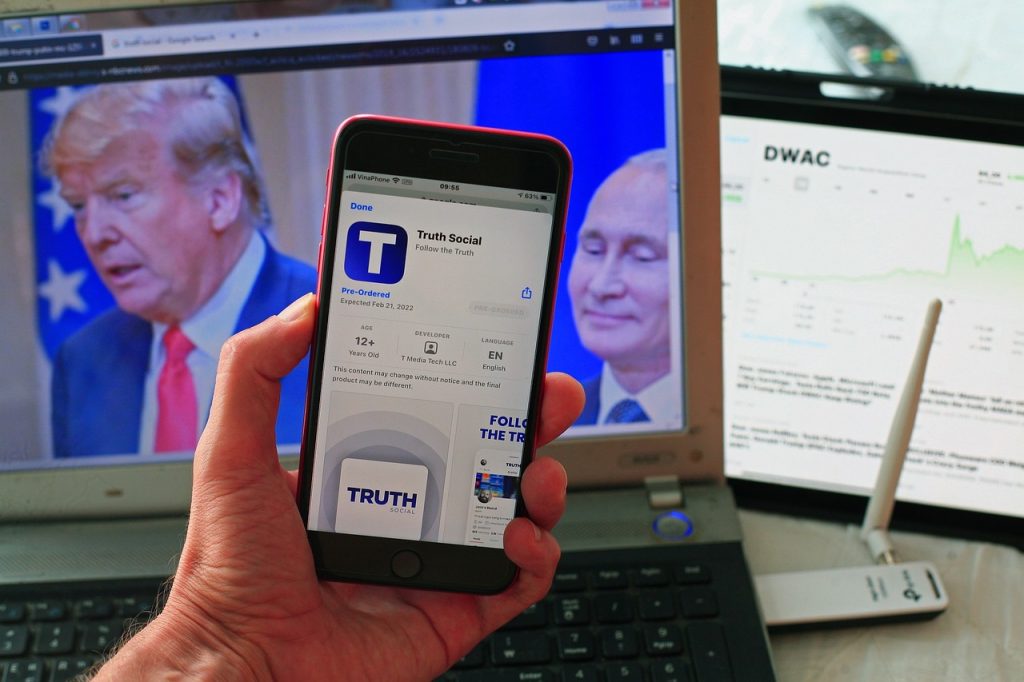

Truth Social is a social media platform developed by Trump Media & Technology Group, an American media, and technology business established in October 2021 by former U.S. President Donald Trump. Truth Social is also known as TRUTH Social. According to others, the platform competes with Parler and Gab in the alt-tech space.

The launch day for the service was February 21, 2022. Since its debut, the Truth Social platform has had serious scaling issues, which has resulted in a lower user base than anticipated. The service was only available to users in the United States and Canada up until May 2022 and could only be accessed through an iPhone app.

Although access is still restricted by geography, the service developed a web app in May 2022 that allows users of any internet browser to visit the site.

Read More: Truth Social for Windows- How To Install Truth Social on A Computer!

Can I Buy Stock in Truth Social?

Truth Social is not publicly listed as of March 2022, hence the company’s stock is not traded on a stock market, making it impossible to purchase stock in the company.

Likewise, Donald Trump has so far decided against publicly listing Trump Media, thus stockholders cannot purchase TMTG. But even while direct stock purchases may not be an option, it is still possible to make investments in companies like Trump Media or Truth Social.

There are ways to indirectly support the social networking platform launched by former President Donald Trump if you’re confident it’ll be the next big mobile application.

Will Truth Social Go Public?

The likelihood is that no. Trump Media revealed its intentions to merge with the special purpose acquisition company (SPAC) Digital World Acquisition Corporation in October 2021.

In contrast to having their own commercial operations, special purpose acquisition firms like DWAC are designed to integrate with and raise money for an existing business. In the event that the merger is approved, Digital World will contribute $293 million to Trump Media, allowing investors to purchase TMTG stock.

However, a number of sources have recently claimed that the SEC is not likely to approve the DWAC and TMTG merger since it is against the law for a SPAC to consider a merger with a potential target before being public.

Multiple accounts claim that Trump and Patrick Orlando, the CEO of DWAC, had previously discussed a merger and that the SPAC was established particularly with the TMTG merger in mind, in violation of SEC rules.

Exist Any Further Investment Options in Truth Social?

Yes, there is a straightforward way for consumers to indirectly support Truth Social — buying DWAC shares. Since DWAC is a special purpose acquisition company, Trump Media’s performance will have a significant impact on the share price of that company.

But before you decide to purchase a bag, it’s important to note that a number of experts have cautioned against investing in DWAC. First, a closer examination is required of DWAC’s current share price of $70, which is a sevenfold rise from the IPO price. You’re probably thinking that a high share price is a positive thing.

Naturally, it is. However, it also contributes to the company’s estimated value, which is close to $15 billion. That’s pretty high for a just-launched business whose operational capability is still unknown.

Second, it’s crucial to keep in mind that following the DWAC/TMTG merger, TMTG – rather than Truth Social itself – would probably be listed on the public exchange.

Despite being Trump Media’s most well-known product at the moment, Truth Social doesn’t appear to have the potential to become the organization’s primary source of revenue in the long run.

In fact, according to TMTG’s own forecasts, the firm would generate $3,665.3 million in revenues in 2026, but only a minor amount (>8%) is expected to come through Truth Social. Instead, the majority of the company’s earnings will come from its streaming platform.

If so, factors other than Truth Social’s success will have an impact on TMTG’s share price. Truth Social may succeed, but if TMTG+ fails to live up to expectations, it is realistic to believe that TMTG’s stock may decline.

Thirdly, the SEC’s examination of the merger of DWAC and TMTG adds another complication. The merger’s approval is uncertain, but if it isn’t, DWAC’s shares will undoubtedly suffer. Additionally, the short-term price volatility that may result from the SEC’s decision’s ambiguity.

Of course, there is always another viewpoint, and DWAC’s shares would probably increase if the merger were approved by the SEC.

However, there is now too much uncertainty surrounding DWAC for its stock to be considered a wise investment. Its share price could yet increase, but for the time being, it’s still a gamble.

How Do I Purchase TMTG Stock?

I must let you know that the Trump Media & Technology Group has not yet been listed on the stock market if you wish to purchase stock in the company. However, they are getting ready to launch the stock as quickly as possible. By December 2021, we should be able to buy and sell shares as the process to get the company publicly traded has already begun.

You can purchase shares of Digital World Acquisition Corp. in the interim (NASDAQ: DWAC). The Trump Media & Technology Group will become a publicly-traded company as a consequence of a corporate merger that DWAC has outlined in a definitive merger agreement.

Read More: TruthSocial.com Login- How to Sign in To the Truth Social App!

The DWAC stock has increased by at least 300 percent since the Announcement gained attention. (Remember: This isn’t any kind of financial advice. A financial manager should be consulted before making any investments. This article is simply meant to provide information.)

To Know More Latest Updates You Can Visit Our Website: Techstry.net